Forecast and Strategic Decision Models Applied to Energy

It concerns the development of analytic tools applied to Energy. Most of the energy-related activities require decision making under uncertainty. These types of models need to explicitly or implicitly represent the uncertainty faced by the decision maker, her/his risk aversion, and the resources available for corrective actions to determine a closed-loop first-stage (or here-and-now) decision. Long-term contracting strategy in energy contract auctions, short-term energy trading, operation of storage units to compensate renewables variability, and expansion planning of infrastructure are only a few examples of applications that make use of both forecast and strategic decision-making tools.

This is a very traditional research theme at LAMPS, under which we conduct a series of academic and R&D projects with industry agents. The projects developed around this theme include:

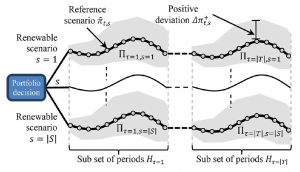

- multistage risk-averse investment strategies in a portfolio of renewable units;

- sharing the quotas of a renewable pool based on cooperative game theory;

- robust contracting strategies for distribution companies;

- long-term renewable generation forecast;

- multimodel probabilistic forecast tool with external variable selection; and

- nonparametric probabilistic forecast for short-term wind power generation.

Some of the main results from these project are:

- academic papers providing new insights and techniques implemented and tested in practice during R&D projects;

- new decision making and forecast software and algorithms developed for industry players;

- more efficient and sustainable decisions based on our findings; and

- human resources development (Master, Ph.D., and Postdoc levels).

For instance, the open-source package in Julia Language developed by LAMPS researchers, StateSpaceModels.jl, has been gaining more and more attention in the forecast community due to its flexibility and new features. This package allows for making probabilistic forecasts of nonstationary stochastic processes decomposing its level, trend, and seasonality. The figure below shows an application of this package to an energy demand time-series of the Energisa group. We show that climate states such as El Niño or La Niña might impact on forecasts in the presence of run-of-river hydro distributed generation units.

It is worth noticing as well the ScoreDrivenModels.jl, also developed by LAMPS researchers as an extension of the package mentioned above. It provides ample flexibility for modeling stochastic processes (time series) defined by arbitrary (non-Gaussian) conditional distributions. An example of such model applied to wind energy forecasting has been published in the IEEE Transactions on Power Systems (the leading scientific journal of the IEEE Power and Energy Society). Access the article here.

Another relevant example in which our findings have provided significant insight to the power system community is shown in the image below. It depicts the uncertainty set representing spot-price spikes, which official price simulation tools are unable to capture but systematically observed in practice. This image was extracted from one of our papers also published in IEEE Transactions on Power Systems. Based on this insight, agents are able to robustify their decision-making process against uncertainty components of difficult modeling oftentimes not considered in forecast models.