Renewable Storage and Flexibility Research Group for Power Systems Sustainability

The decarbonization and energy transition agenda has prompted a global shift in the generation matrix, leading to a vast integration of renewable resources. New climate patterns and their linkage to […]

LAMPS DataHub - Monitoring and Power System Indices

[LAMPS DataHub] - In this application, we provide monitoring indices for the Brazilian power system. The first index showcases the wind and solar power generation performance in percentage values of […]

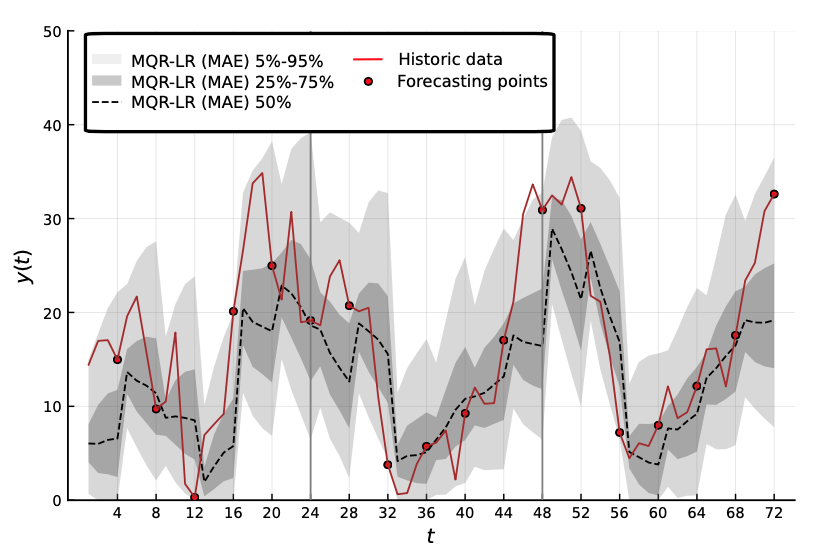

Automation of probabilistic time series forecasting: a new multimodel framework with optimal selection of explanatory variables applied to electricity consumption series.

The R&D project carried out with Energisa aims to create a new multimodel automation framework for the simulation (probabilistic forecasting) of time series with optimal selection of explanatory variables. The […]

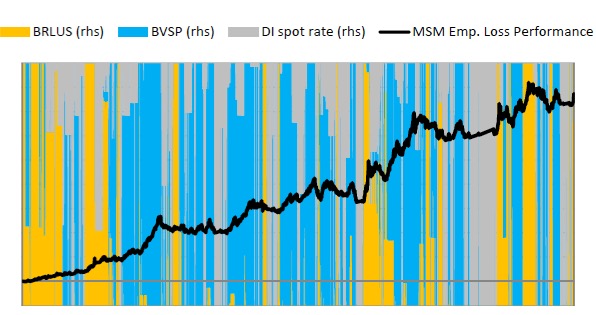

P&D ANEEL - ENEVA - Forward Curves for Electricity Markets

The objective of the project was to develop a methodology for estimating and forecasting the forward curve of electricity, materialized in a web tool prototype that enables the realization of […]

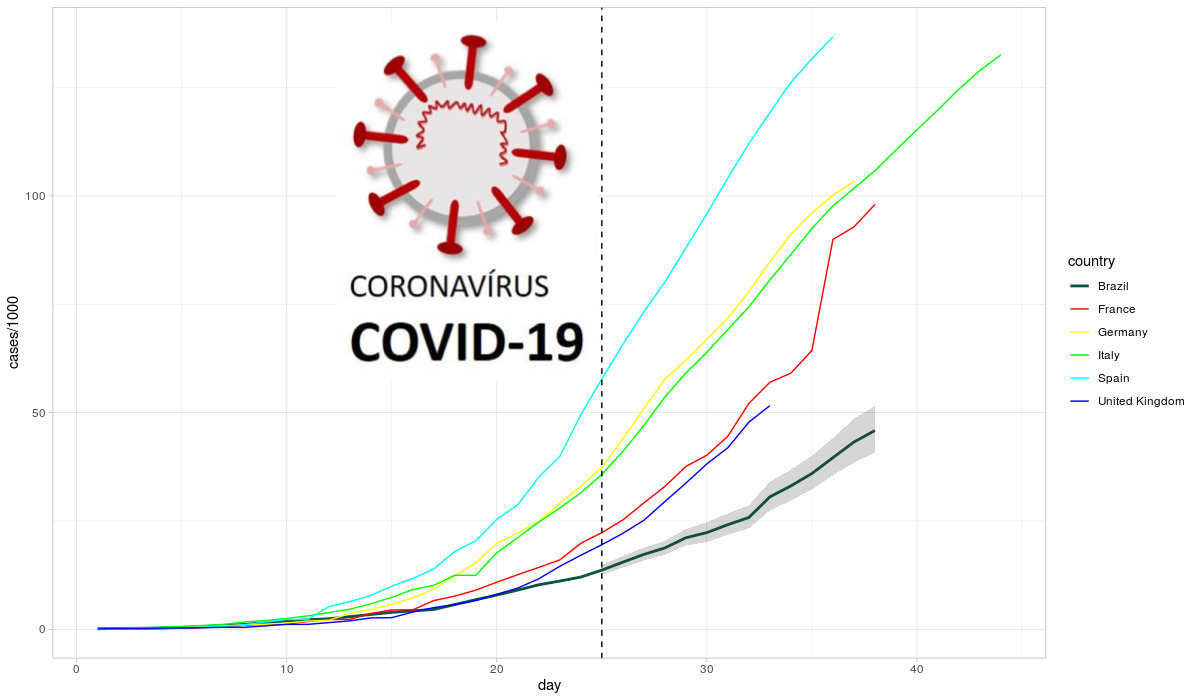

COVID19analytics.com.br

Updated forecasts for the number of reported cases and deaths due to COVID-19 in Brasil - COVID19analytics.com.br This is an initiative of Prof. Alexandre Street (Electrical Engineering department at PUC-Rio), Davi […]

Analytics Tools

Energy Analytics - Monitoring and Forecasting Power System Indices [Click here to access the application] - monitoring indices for electricity consumption reduction in Brasil after COVID19. In this app we […]

Incorporating the effect of climate variability and contingencies in the optimal contracting strategy of transmission-usage amounts

R&D project between Energisa and LAMPS-PUC-Rio The main goal is to develop a computational tool capable of accounting for the uncertainty due to contingencies and climate variability in the optimal […]

Confiabilidade na integração de recursos renováveis considerando variações climáticas

This project is supported by the Chilean government, under the CONICYT PCI/REDES 150008 - 2015 call. The aim of the project is to support international-network cooperation projects between research centers. In […]

Stochastic Dual Dynamic Programming Dispatch Tool

Sponsor: FGV. 2017. Development of a Stochastic Dual Dynamic Programming Dispatch Tool for simulating the dispatch of gas-to-wire thermal generation power plants.

Young Talents Attraction Program - Level A: Robust and probabilistic models for electricity power systems operation and planning with significant renewable energy integration

Young Talents Attraction Program - Level A Granted: David Pozo Coordinator: Alexandre Street Sponsor: CAPES-CNPq-MCTI SUMMARY Decision-making under uncertainty plays a key role in the operation and planning of restructured power systems. […]

FAPERJ Research grant for lab development in the state of Rio de Janeiro: Optimization models for power system planning under high levels of renewable integration

Sponsor: FAPERJ. 2014

Optimal Demand Contracting Strategy of a Distribution Company With the Transmission System Under High Level of Renewable Distributed Generation

Sponsor: Energisa group. Goal: To define the optimal amount of power flow contract that should be contracted for the next 4 years with the transmission system by a distribution company.

Forecast and Strategic Decision Models Applied to Energy

It concerns the development of analytic tools applied to Energy. Most of the energy-related activities require decision making under uncertainty. These types of models need to explicitly or implicitly represent the […]

Robust and Stochastic Optimization Models for Power Systems Planning and Operation

It concerns the study and development of mathematical optimization models and solution methodologies based on stochastic or robust optimization applied to power system planning and operation problems. Transmission and generation expansion […]

Hydrothermal system operation planning

It concerns the analysis and optimization of hydro-thermal system operation planning and its resulting policies.

Quantitative methods for finance

Portfolio optimization models, Asset Liability Management (ALM) models, computational finance, risk analysis and associated aspects of optimization under uncertainty (robust and stochastic optimization) and risk measure.

Modelo interno (seguros e previdência): Otimização simultânea do capital baseado em risco e da carteira de ativos

Tópicos de pesquisa: Modelo interno, capital mínimo requerido, Solvência II, otimização robusta

Otimização sob incerteza aplicada à gestão de ativos e passivos

Research topics: Asset Liability Management (ALM) models, computational finance, risk analysis, and theoretical aspects of optimization under uncertainty such as stochastic dynamic programming models and robust optimization models.

ESTRATÉGIAS DE FORMAÇÃO DE UM POOL MISTO DE ENERGIA RENOVÁVEL E CONVENCIONAL NO ACL (P&D ANEEL PD-7625-0001/2013)

Sponsor: ENEVA. 2012. We present a new methodology to support an energy trading company (ETC) to devise contracting strategies under an optimal risk-averse renewable portfolio. The uncertainty in the generation […]

AUMENTO DA COMPETITIVIDADE NA COMERCIALIZAÇÃO DE CONTRATOS DE ENERGIA PROVENIENTE DE FONTES RENOVÁVEIS NO ACL (P&D ANEEL PD-0678-0310/2010)

Sponsor: UTE Norte Fluminense (EDF). 2011 Goal: a renewable generation simulation tool capable to produce a Monte Carlo Simulation of a set of renewable units conditioned (paired) to the scenarios […]

Corporate Asset and Liability Management

Research topics: Asset and liability management, multistage stochastic programming, risk management, time series simulation models.

Asset Liability Management model for Angola public pension institute

The ALM system developed in this project envisions finding the optimal investment portfolio for the public pension fund of Angola while keeping a low insolvency risk.