Autor: davimv

Confiabilidade na integração de recursos renováveis considerando variações climáticas

This project is supported by the Chilean government, under the CONICYT PCI/REDES 150008 - 2015 call. The aim of the project is to support international-network cooperation projects between research centers. In […]

Hydrothermal system operation planning

It concerns the analysis and optimization of hydro-thermal system operation planning and its resulting policies.

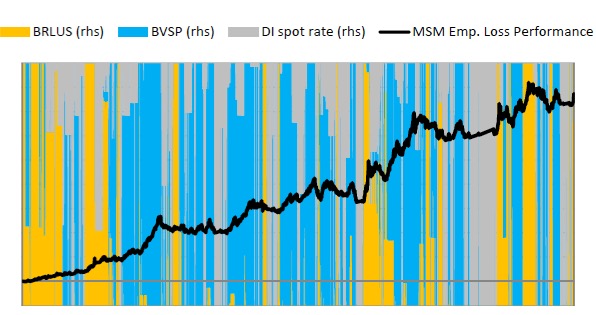

Quantitative methods for finance

Portfolio optimization models, Asset Liability Management (ALM) models, computational finance, risk analysis and associated aspects of optimization under uncertainty (robust and stochastic optimization) and risk measure.

Modelo interno (seguros e previdência): Otimização simultânea do capital baseado em risco e da carteira de ativos

Tópicos de pesquisa: Modelo interno, capital mínimo requerido, Solvência II, otimização robusta

Otimização sob incerteza aplicada à gestão de ativos e passivos

Research topics: Asset Liability Management (ALM) models, computational finance, risk analysis, and theoretical aspects of optimization under uncertainty such as stochastic dynamic programming models and robust optimization models.

ESTRATÉGIAS DE FORMAÇÃO DE UM POOL MISTO DE ENERGIA RENOVÁVEL E CONVENCIONAL NO ACL (P&D ANEEL PD-7625-0001/2013)

Sponsor: ENEVA. 2012. We present a new methodology to support an energy trading company (ETC) to devise contracting strategies under an optimal risk-averse renewable portfolio. The uncertainty in the generation […]

AUMENTO DA COMPETITIVIDADE NA COMERCIALIZAÇÃO DE CONTRATOS DE ENERGIA PROVENIENTE DE FONTES RENOVÁVEIS NO ACL (P&D ANEEL PD-0678-0310/2010)

Sponsor: UTE Norte Fluminense (EDF). 2011 Goal: a renewable generation simulation tool capable to produce a Monte Carlo Simulation of a set of renewable units conditioned (paired) to the scenarios […]

Corporate Asset and Liability Management

Research topics: Asset and liability management, multistage stochastic programming, risk management, time series simulation models.

Asset Liability Management model for Angola public pension institute

The ALM system developed in this project envisions finding the optimal investment portfolio for the public pension fund of Angola while keeping a low insolvency risk.