Optimized Expansion Auction (LEO: Leilão de Expansão Otimizada)

Wirtten by Alexandre Street

This is part of an ongoing work with Rafael Benchimol, Joaquim Garcia, Luiz Barroso, and Bernardo Freitas that will soon be published.

April 20, 2025

The Brazilian electricity market has undergone significant structural transformations over recent decades, heavily marked by the continuous and growing use of subsidies. Originally designed as strategic incentive instruments to promote universal access and diversify the energy matrix, these subsidies, particularly the Energy Development Account (CDE), have progressively drifted away from their initial goals. Created in 2002 by Law 10.438, the CDE was intended to ensure universal access to electricity and foster renewable sources through targeted and temporary subsidies, with a clearly defined sunset in 2027. However, after major regulatory changes in 2013—especially Law 12.783—these incentives became almost permanent and considerably expanded, resulting in an exponential rise in associated costs, which increased from under R$5 billion in 2012 to over R$40 billion in 2024.

One of the direct consequences of this scenario is the uncoordinated expansion of non-dispatchable intermittent renewable sources, such as wind and solar. Although essential for the energy transition and the diversification of the power mix, these sources have reached a level of maturity that no longer fully justifies the continued use of such high subsidies.

It is important to highlight that these sources have a unique characteristic that sets them apart from conventional ones: they increase the total energy supply (total MWh produced over the month or year) to the system, but because they rely on weather-dependent resources (sun and wind) that fluctuate randomly, they also increase the system’s demand for flexibility and controllability (i.e., the ability to vary and precisely set generation every second).

The power system must remain balanced between generation and demand at all times to avoid collapse. Therefore, sources that inject energy randomly impose additional nontrivial compensation tasks on controllable sources (ancillary services), which compete with traditional energy supply services remunerated by the market. As a result, the continued subsidization of such sources has led to deep structural imbalances in the sector, producing significant market distortions. These distortions make the electricity market effectively dysfunctional, unable to fulfill its fundamental role: to incentivize the most valuable resources for the system and disincentivize those that are unnecessary or oversupplied.

As a stopgap solution to mitigate these imbalances, reserve capacity auctions (LRCAP - "Leilão de Reserva de CAPacidade" in its Portuguese acronym) with technology-specific quotas for thermal power plants have recently been proposed. While these aim to ensure energy security and system reliability, the current auction design exhibits several flaws, particularly in how operational benefits are calculated. One example is the fixed assumption of 120 annual dispatches per project to meet peak demand, regardless of each project’s variable cost. This flawed benefit calculation, combined with a market reservation logic that favors specific technologies, results in economically inefficient and regulatorily questionable outcomes. Moreover, these auctions fail to properly assess critical attributes such as energy, operational flexibility, emissions, ancillary services, and the actual ability to meet peak demand, leading to short-sighted allocations and unnecessary additional costs.

It is also important to note that the LRCAP, designed to procure additional capacity to be used during critical moments, will, in effect, also contract the energy and other attributes of the selected resources. The problem is that relying on thermal plants selected primarily for their capacity to deliver all other attributes, especially energy, may not be optimal. Given these limitations, it is imperative to pursue a new auction format that is technology-neutral and capable of evaluating, in an integrated and endogenous manner, all the relevant attributes required by the Brazilian electricity system. Such an approach is necessary to reduce existing imbalances between sources, avoid additional distortions, and promote a more sustainable, fair, and efficient expansion path—especially for the consumers footing the bill.

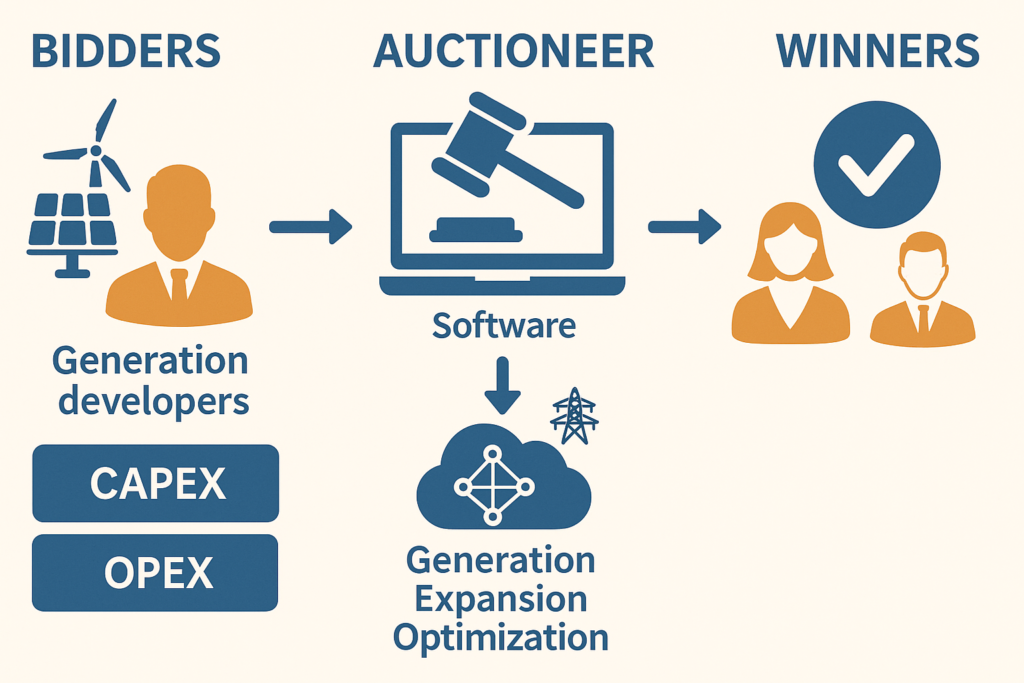

In light of this, we began to study an alternative and innovative auction mechanism, which we call the Optimized Expansion Auction (LEO - "Leião de Expansão Otimizada", in its Portuguese acronym). The LEO is designed as an auction where bidders submit cost and technical parameters of their projects, just as in traditional energy auctions, but the auctioneer selects the winning projects using an integrated generation and transmission expansion model. See the infographic below.

The underlying thesis is that auctions are efficient mechanisms to reveal bidders’ true costs and identify the best technological and financial combinations. Meanwhile, expansion and operation models are effective in computing optimal portfolios and quantifying the benefits of integrated operation among different sources, given their costs and configurations.

Thus, the proposed design aims to unify two approaches previously seen as alternatives: new capacity auctions and centralized planning processes. LEO seeks to combine the strengths of both to create a hybrid mechanism that can support system expansion when needed. It is worth noting that the proposed structure, in which the auctioneer is replaced by optimization software, is already widely used in day-ahead market auctions in more mature systems (PJM, CAISO, ERCOT, etc.). In these markets, agents submit plant parameters, and the auctioneer runs a network-constrained unit commitment model to determine the winning offers for the next day. The innovation in LEO lies in applying this optimizer-auctioneer idea, well-established in American day-ahead markets, to long-term capacity expansion planning.

More concretely, LEO’s objective is to select generation projects that minimize the total investment and operating costs, subject to the reliability criteria defined by the system operator, given the submitted offers (CAPEX, OPEX, and other project parameters). In this process, the expansion software acting as the auctioneer must evaluate in detail the operational benefits of integrating candidate sources with the existing generation fleet and transmission network. Therefore, LEO selects projects as part of an optimal portfolio, chosen from all possible combinations that meet cost and reliability targets. Unlike combinatorial auctions, where multiple products are defined and the auctioneer combines multi-attribute bids to maximize total system value, LEO endogenously accounts for all system needs (energy, capacity, flexibility, ancillary services, location) within the optimization software.

This design eliminates the need for physical guarantee calculations, predefined flexibility metrics, or regional/technology-specific auctions. Projects are compared solely based on their value to consumers. If one project has slightly higher fixed costs (CAPEX and OPEX) but delivers power at the right location and with the right attributes, it will be selected, just as in a centralized deterministic planning process. The difference is that the planner doesn’t need to determine project costs or commercial arrangements, which are best left to entrepreneurs. Moreover, the LEO can and should incorporate the expansion of the transmission network and gas infrastructure, for instance, to ensure that the selected plants are the most cost-effective options from a system-wide perspective.

In a broader context, LEO can be viewed as a more structural and alternative solution not only to LRCAPs but also to New Energy Auctions and Reserve Energy Auctions. It relies on a traditional expansion process, already in use and well understood by institutions like EPE ("Empresa de pesquisa Energética", the Brazilian Planner). However, unlike existing auctions that are heavily focused on generators, LEO shifts the focus to consumers, making explicit the required service quality level and total cost. As a result, LEO reduces the need for auctions by source or region to make up for previously overlooked attributes due to the limitations of older auction designs. Finally, LEO is adaptable to any power system in the world, as long as the expansion model is appropriately chosen to meet the specific regulatory requirements.

This is still a conceptual design under development. We are currently testing its structure as part of Rafael Benchimol Klausner’s master’s thesis, with support from a highly qualified group of collaborators: Joaquim Dias Garcia, Bernardo Freitas Paulo da Costa, and Luiz Barroso. We are now working on computational tests to validate the ideas and assess the benefits compared to existing designs.