Optimization under uncertainty applied to asset and liability management

Research Grant: CNPq - Chamada Universal 2014

Abstract:

this project focus on technological innovation, scientific production, human resources training and practical application of the developed techniques. The objective is the development of cutting-edge research in quantitative finance and optimization under uncertainty aiming at international publications in the main journals, participation at major conferences of the area and sponsored Research and Development (R&D) projects, with direct participation of doctoral, masters and undergraduate students. Additionally , the proponent will have teaching activities including an undergraduate and a graduate course with content directly related to this project.

The main topics of the project include portfolio selection models for asset allocation, Asset Liability Management (ALM) models, computational finance, risk analysis, and theoretical aspects of optimization under uncertainty such as stochastic dynamic programming models and robust optimization models. This project encompasses theoretical development and practical application of static (a period) and dynamic models for selecting assets and / or liabilities in different contexts, such as hedge funds, pension funds, insurers, re-insurers, banks and large corporations. Models and tools developed in this project have technological innovation potential with direct contribution to investment management sector, especially hedge funds, pension funds and insurance companies.

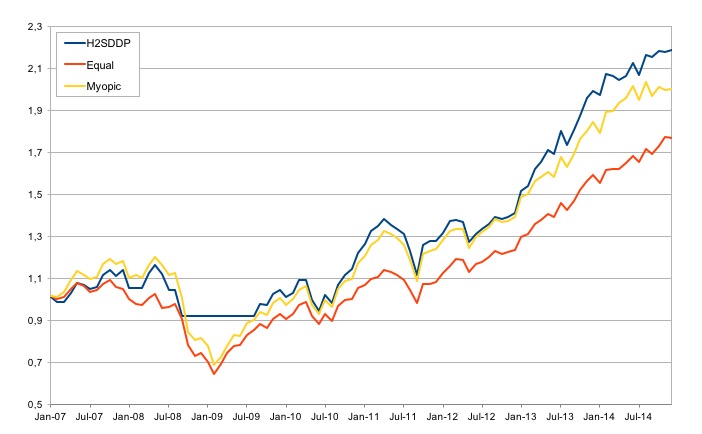

Cumulative portfolio return